You must have observed that inflation has been coming to the headlines a lot lately. After many years of being ignorant of inflation, it has become a hot topic for everyday conversation.

This simply means Australians are experiencing a hike in consumer prices, a collective result of multiple factors. It is understandable as higher prices have put a strain on people’s budgets.

Latest CPI news, 6.1% on the June quarter.

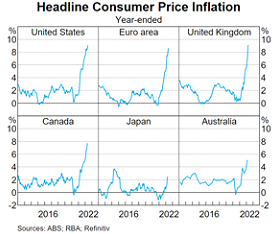

The latest, June quarter reading on CPI inflation shows an inflation rate of 6.1%. The rate might be lower than most countries but it’s the highest it has been since 1991 and much higher than expected by the Australian economy (Graph 1).

If you regularly transfer money overseas, you are likely to be impacted because inflation can affect both value of the currency as well as the foreign exchange rates.

Hence, if you're someone wanting to move your money around the world or are looking to make smart investments, it would be ideal to keep yourself updated on the news pertaining to interest rates, inflation and the financial markets in general.

Inflation and Interest Rates.

The Australian Bureau of Statistics (ABS) released the inflation or CPI data for the June 2022 quarter. Here are the highlights-

- The Consumer Price Index (CPI) increased by 1.8% this quarter.

- Over 12 months to the June 2022 quarter, the CPI rose 6.1%.

- The most significant rise has been observed in housing (5.6%), Automotive fuel (4.2%) and furniture (7%)

If it continues higher above 3%, the central bank may be forced to increase interest rates sooner than previously forecast.

Interest Rate and the Australian Dollar (AUD).

What if the interest rates increase sooner than expected?

Well, interest rates and interest rate expectations have a big influence on the value of the Australian dollar. If the interest rates are expected to increase more, you can expect investment flows.

Theoretical economics indicates that, the value of a currency appreciates when the interest rate is hiked.

Hence, if the rate of interest goes up in Australia, so does the AUD. Another thing to keep in mind is that the currency of other countries is also increasing at a given rate. For e.g., if the interest rate in the US and Australia are increasing at a similar pace, this leaves the USD to AUD exchange rate relatively unchanged.

How does inflation impact your overseas business?

Circling back to inflation, it affects international money transfers. But, panic not, as long as the official cash rate is stable and the inflation rate is within the expected range.

For Australia, the inflation target is to keep consumer prices at an average of 2-3%. This target is flexible and allows for unseen temporary fluctuations. You can be out of worry as currently, the inflation rate is within the expected range. Also, the interest rate in Australia has been unchanged for a while and has been stuck below 1% for some time now.

The RBA however cannot predict how other countries move with their currencies. In the best-case scenario, you can only work with the data available to take control of any possible volatility, in our case when transferring money.

EREMIT Money transfer tips for your business.

If you are worried about the impact of potential inflation and inflation rates and how will they affect your money transfer, here are a few things you can do.

- Stay updated with the latest news and currency changes.

- You can also set up alerts for your desired interest rates.

- Look out for hidden fees!

Also, if you are looking for international money transfer providers, you give us a visit on https://eremit.com.au/. We offer great exchange rates and low fees, plus the process is extremely uncomplicated with just five simple steps!